Wawa Credit Card offers an online portal that allows users to log in to pay bills and activate a new card. Comenity Bank issues the credit card and cardholders can set up a flexible payment system and get discounts at Wawa pumps. The credit card company offers expert support and solutions in case of identity theft. Logging into your account gives you access to transaction history, view accrued bonus points, update account information, view unbilled charges and current statements, and opt in to eStatements. Once logged in, you can recover your password or username. Below, we provide a detailed set of guidelines for logging in and paying credit card bills.

Logging into your account gives you access to transaction history, view accrued bonus points, update account information, view unbilled charges and current statements, and opt in to eStatements. Once logged in, you can recover your password or username. Below, we provide a detailed set of guidelines for logging in and paying credit card bills.

Or

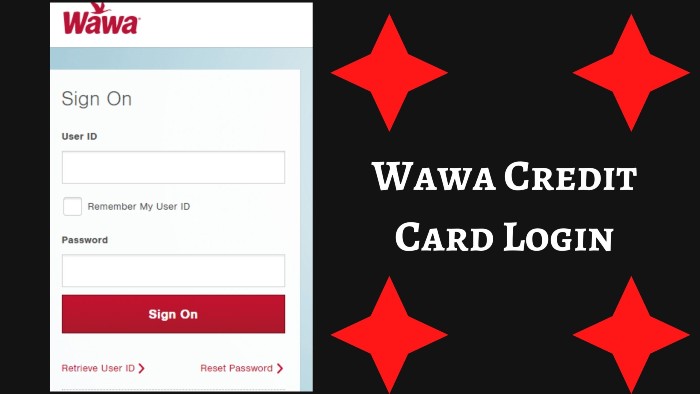

How To Login A With Wawa Credit Card?

Let’s get this guide started and look at Wawa credit card online registration methods. They are as mentioned below. Never forget a step to register with your Wawa credit card; Read the step below.

Step 1: First of all, visit Wawa Credit Card’s official website or click this link [https://citiretailservices.citibankonline.com/RSnextgen/svc/launch/index.action?siteId=PLOC_WAWA#signon ].

Step 2: After visiting the Wawa Credit Card homepage, click on the login portal.

Step 3: After that, enter your Wawa credit card ID and password. Step 4: After entering your Wawa Credit Card User ID and Password, click Login.

Step 4: After entering your Wawa Credit Card User ID and Password, click Login.

Step 5: You have successfully logged in to the Wawa Credit Card online portal.

I hope that after reading the above steps, you can easily access the Wawa credit card online portal.

If you already have this Wawa credit card, you can register for online access and manage it online by following the steps above. As a result, you can check your balance or pay your credit card online. However, you must log in each time you wish to do so. The connection is very simple. In fact, here you only need your username and password to access the online account.

Please note that you can request a credit limit increase by calling the customer service number on the back of your credit card; However, calling more than twice a year is not recommended. Your card issuer will also periodically review your account to determine if you qualify for a credit limit increase. Keeping your credit score low and making on-time payments are the most important factors in getting unsolicited credit line increases.